Wyoming Wills

Benjamin Franklin when said that there are two points particular in life: death and tax obligations. Though we’re commonly collaborated with the last, we prevent the former until it is far too late. Planning for our very own death is something that lots of people never think about. We wear’t want to which’s completely reasonable.

Yet leaving this globe without having a prepare for your loved ones and your valuables can cause some problems. Let’s discuss why you need a Will.

What Is a Will?

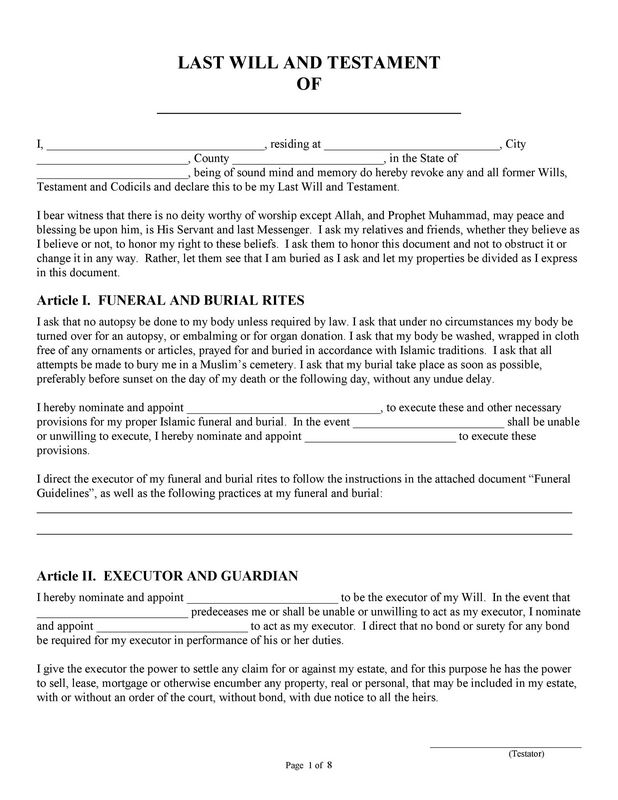

A Will is a legal document specifying your desires upon your fatality. They frequently include the distribution of your building, who will certainly look after youngsters and animals, and in some cases, what your wishes are concerning your funeral arrangements. You may likewise consist of contributions for companies you are passionate concerning, requests for unique plans for loved ones (such as the stories of husbands prepaying for Valentine’s Day blossoms years in advance), or needs pertaining to inheritance.

There are lots of means to create Wills, though a prominent technique is a Video clip Will. The attorney functions as the recorder of the video and permits you to resolve your after-life affairs.by link Minnesota Last Will website It gives the household one last chance to say goodbye, hear your voice, and enjoy who you were. These Wills are not a replacement for created Wills and have to be accompanied by a traditional Will, in print, to be carried out.

What Occurs Without One?

In a word: Mayhem. Though you might have made your demands known to loved ones, they have little legal capacity to impose them without paperwork. Even if your savings account is empty, you might still have a home, a vehicle, or even a specific ceramic cat that three of your grown-up children desire in their specific homes. And for those with considerable estate left behind? A Will is a necessity.

With a Will, each of your possessions is thoroughly led to its brand-new home. Whether it is cash, a home, a vehicle, or your meals, whatever lands where it is supposed to. Without a Will, your member of the family are stuck divvying up your possessions like a flea market.

Along with this, if you have significant financial obligation left, you may leave a lot of quarrel to your family members and enjoyed ones. A Will is the most safe method to ensure a very easy change for your family when you’re gone. Better yet, they aren’t extremely difficult documents and lawyers procedure numerous hundreds of them per year.

Executing a Will

Performing a Will merely suggests that you’re making it legal. Regulations vary from one state to another, however in the majority of states:

- You’ll sign it while you’re still of sound mind and body.

- Have 2 witnesses authorize it at the same time.

- Have it notarized.

That’s it.

You’re completed. You may also pick to connect a self-proven sworn statement to the Will. This allows the probate court to approve the Will after your passing away without the witnesses existing. This is particularly useful if your witnesses are hectic people or perhaps not able to drop what they’re doing in the event of your unfortunate loss. Self-proven Wills are extremely common in large estates. These are already intricate issues and need a great deal of work from the Executor as it is. Many huge estate proprietors make use of self-proving sworn statements to make the process simpler for everyone entailed.

Your Executor has nothing to do with executing your Will, though both sound very comparable. But they have whatever to do with the court of probate.

What Is Probate?

Probate is the court-supervised process of both carrying out a Will and authenticating it. As pointed out over, if a sworn statement exists this procedure is generally accelerated. As soon as the court has developed the credibility of the Will file, your desires will certainly be accomplished. Administrators utilize Wills as overviews for establishing what goes where, who involves any possible analysis of the Will (some family members do this, others do not), and amounting to out your final expenses. Taxes, funeral service or cremation prices, sales of valuables, contributions, and points like that are all part of their task.

When a Trust fund Is Needed

For those on the affluent end of the range, a Count on is almost always needed. In situations where there isn’t a sole family member exceptionally diligent with economic issues, the use of Count on paperwork ends up being paramount. This aggressive economic method not only adds to the longevity of your family members’s wide range however also makes sure that future generations will certainly be well-provided for, cultivating a legacy of economic security.

Final Ideas

Absence of a Will can complicate the distribution of your assets, possibly triggering family members problems. Luckily, the legal process for producing a Will is straightforward and offers peace of mind. If you have extra queries or require aid with estate planning, we highly advise talking to a seasoned estate preparation lawyer. Planning for the future is a liable and caring represent your family’s health.